At 1,550, property sales posted on the FVREB’s Multiple Listings Service (MLS®) were 72.6 percent higher than sales recorded last month. Although 39.9 percent lower than a year ago and nearly 25 percent below the ten-year average, it marks the first time since August that monthly sales exceeded the 1,000 level.

“After months of uncertainty made it difficult for buyers and sellers to re-enter the housing market, we may well be seeing a turning point,” said Narinder Bains, Chair of the Fraser Valley Real Estate Board. “The pause in rate hikes has helped to restore a much-needed sense of predictability, which is building consumer confidence. As a result, we’re starting to see more traffic at open houses along with more multiple offer situations.”

As in all regions across the province and the country, low supply is still an issue and a primary factor driving price growth.

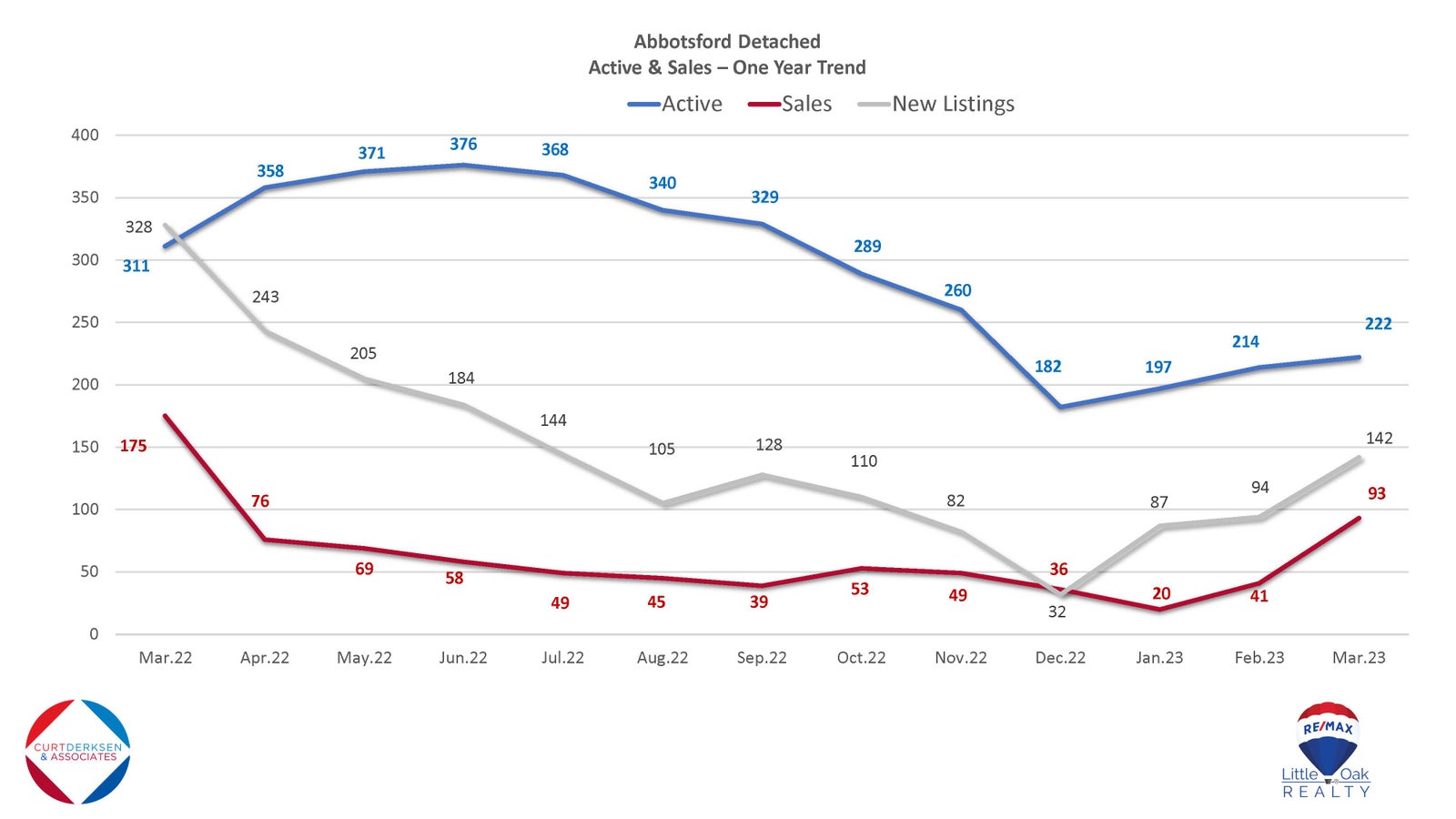

New listings, at 2,559, were 32 percent higher than in February, but still 44.1 percent below last year, while active listings were up by 2.8 percent over last month and 3.5 percent below last year. However, both are well off the ten-year average and among the lowest March listings recorded in a decade.

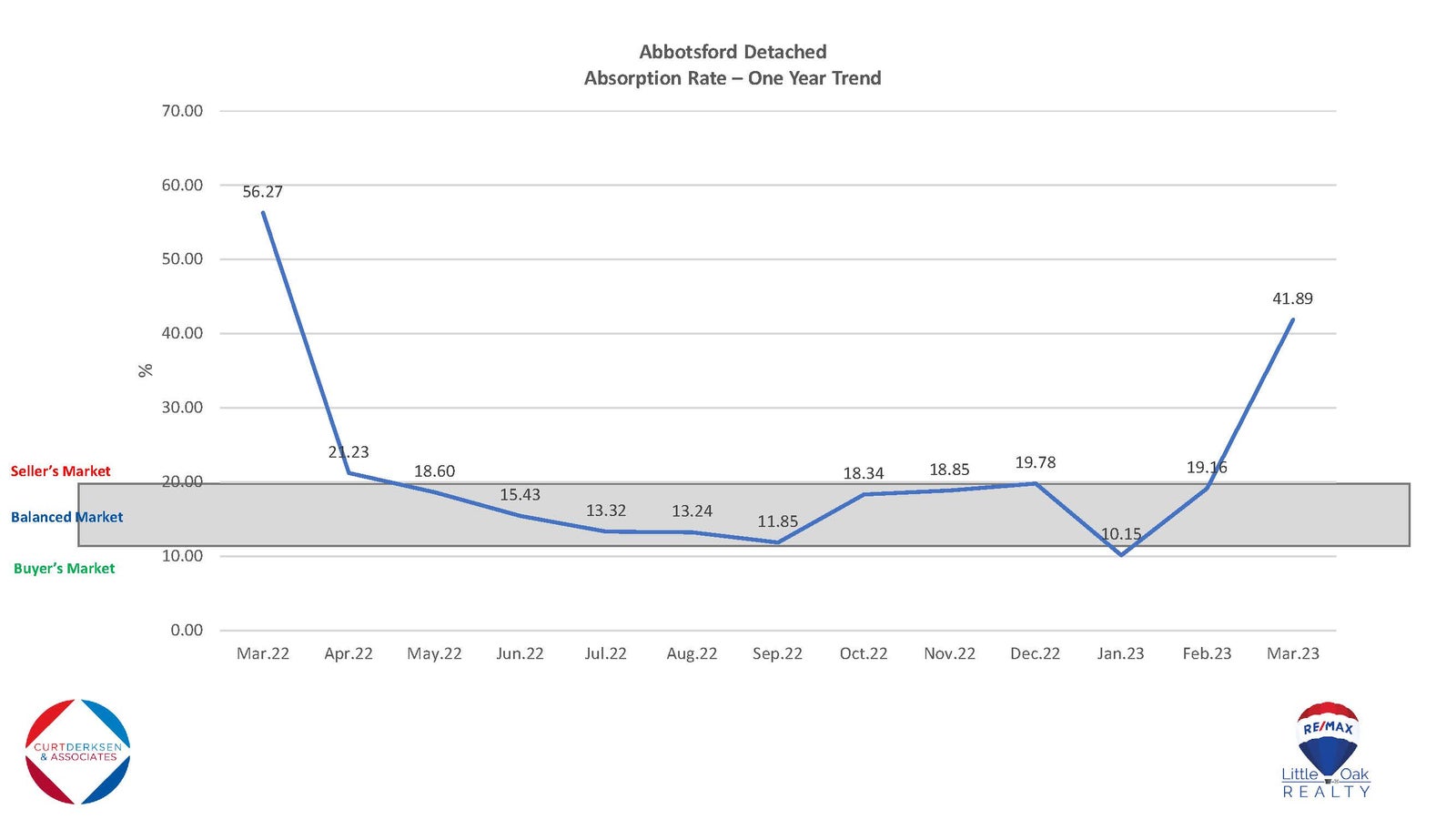

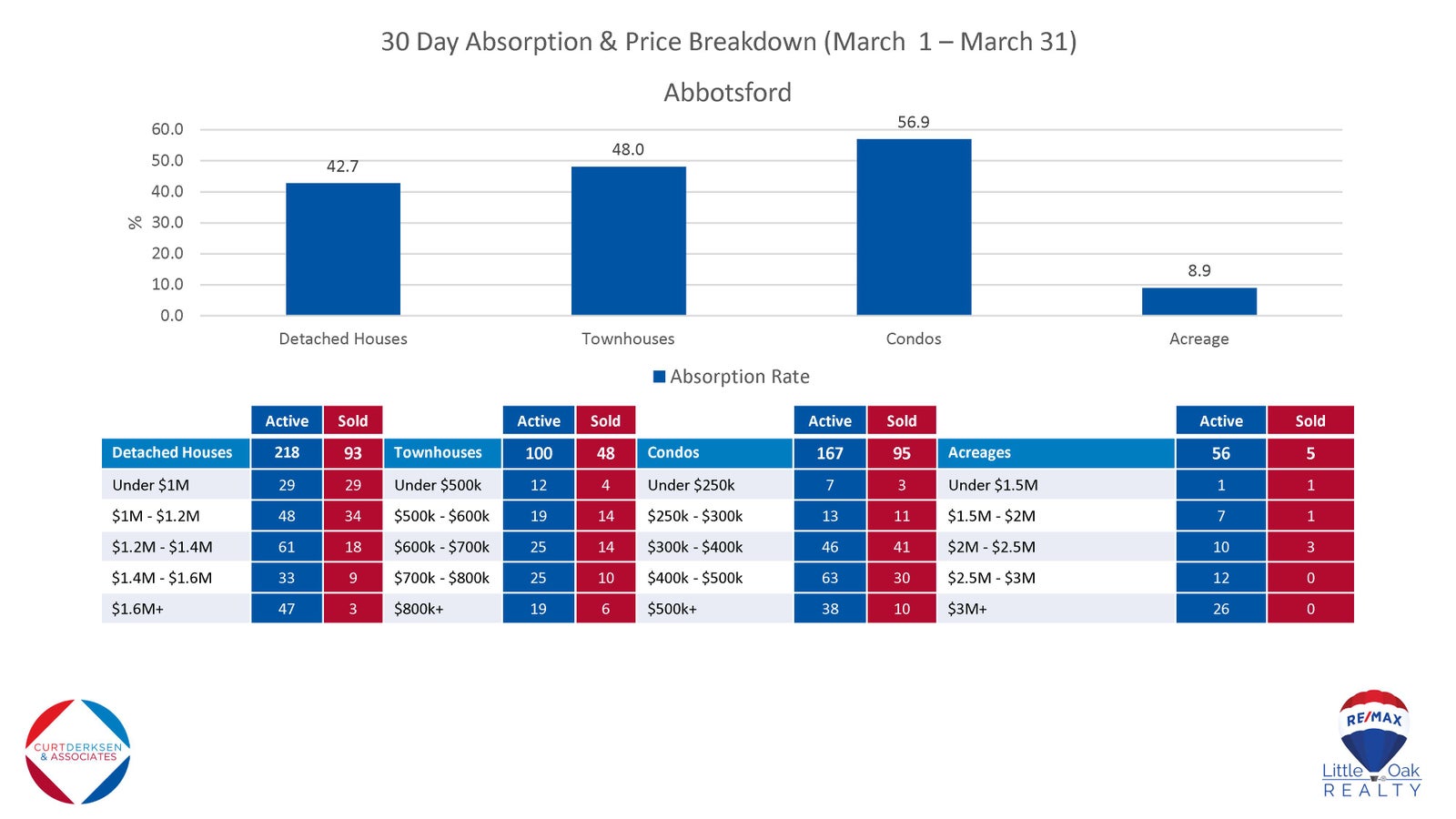

As a result, the aggregate sales-to-active listings ratio grew to 34 percent, shifting the market into sellers territory, with demand for townhomes even more pronounced, at a 62 percent ratio. (The market is considered balanced when the sales-to active listings ratio is between 12 percent and 20 percent.)

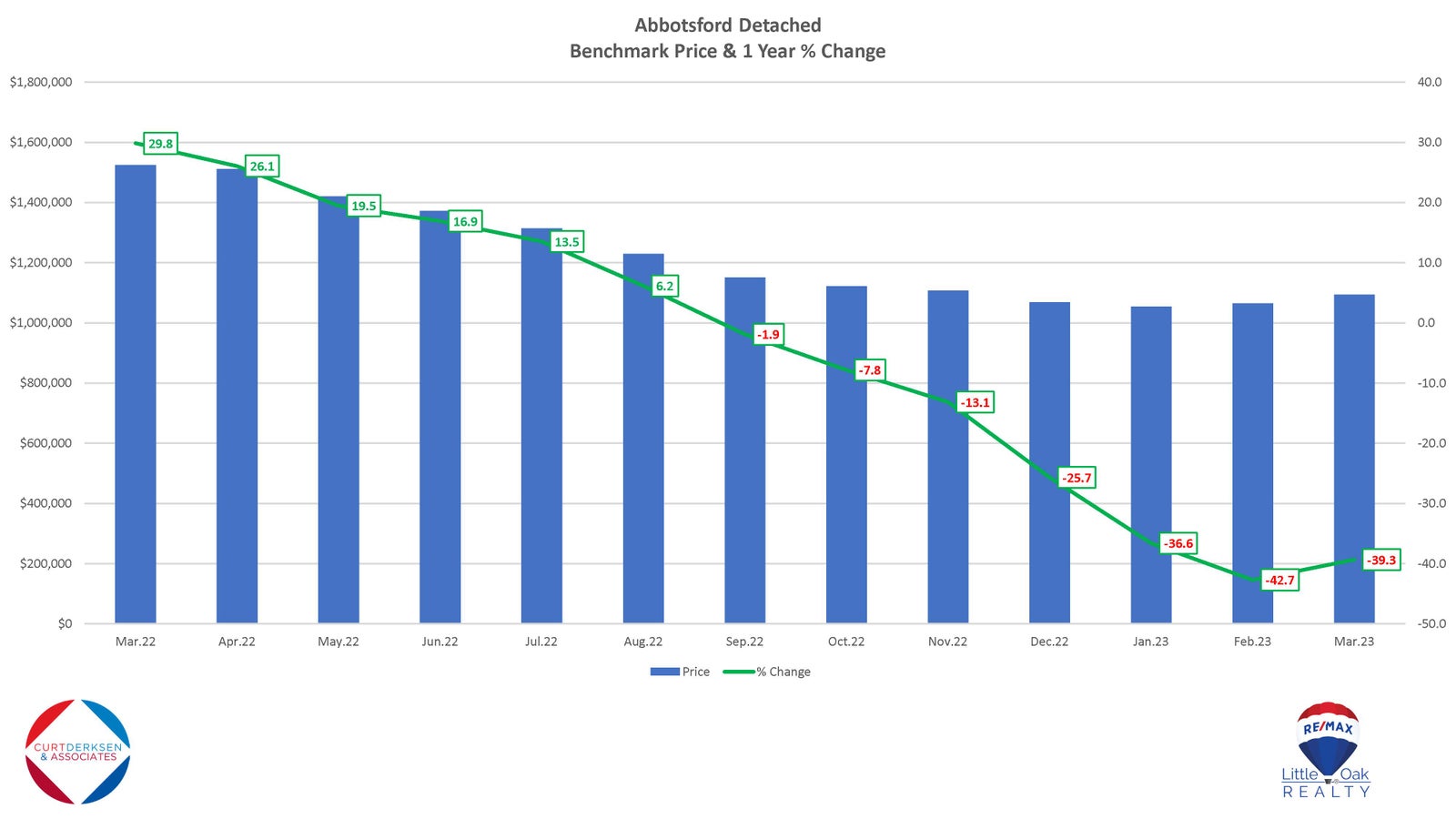

Benchmark prices continued to edge upward with roughly two percent month-over-month growth across all categories. The composite Benchmark price was $965,100 in March.

“While market demand continues to trend up, we still face an uphill battle on the supply side, which is keeping prices elevated,” said FVREB CEO, Baldev Gill. “The province will require sustained inventory growth of at least 25 percent over each of the next five years in order to normalize inventories. Until then, we strongly advise buyers and sellers to consult with a REALTOR® to plan the best strategy.”

Properties spent slightly fewer days on the market compared to last month with detached homes posting 30 days on the market and apartments 29. Townhomes moved faster, at 26 days.

MLS® HPI Benchmark Price Activity

• Single Family Detached: At $1,390,600 the Benchmark price for an FVREB single-family detached home increased 1.9 percent compared to February 2023 and decreased 21.7 percent compared to March 2022.

• Townhomes: At $794,400, the Benchmark price for an FVREB townhome increased 2.3 percent compared to February 2023 and decreased 14.5 percent compared to March 2022.

• Apartments: At $521,800 the Benchmark price for an FVREB apartment/condo increased 2.3 percent compared to February 2023 and decreased 11 percent compared to March 2022.