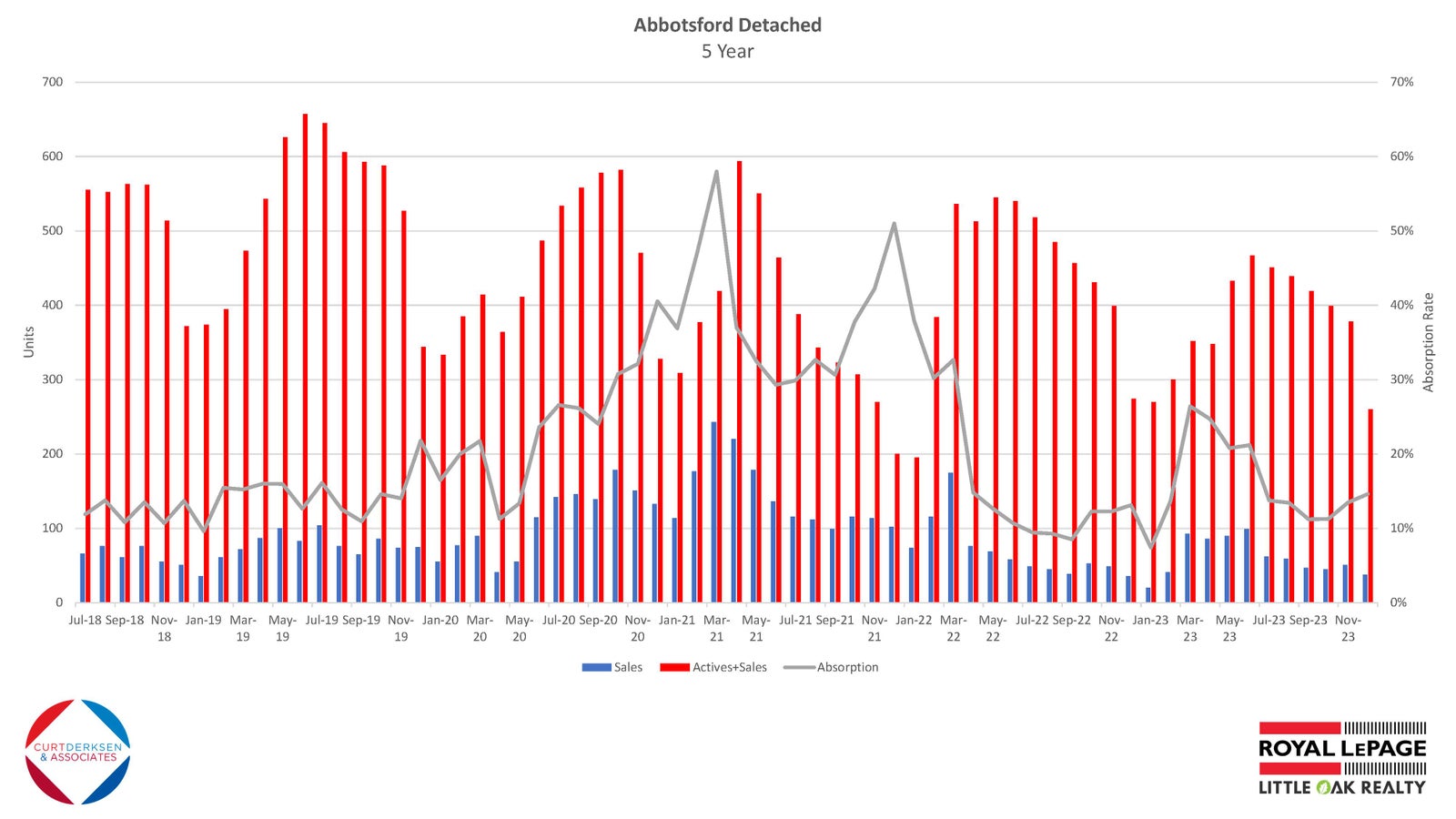

The Fraser Valley region ended the year with 14,713 sales recorded on its Multiple Listing Service® (MLS®), a decline of four percent over 2022 and 23 percent below the 10-year average. New listings in the Fraser Valley were also at a 10-year low, at 29,610, eight percent below the 10-year average.

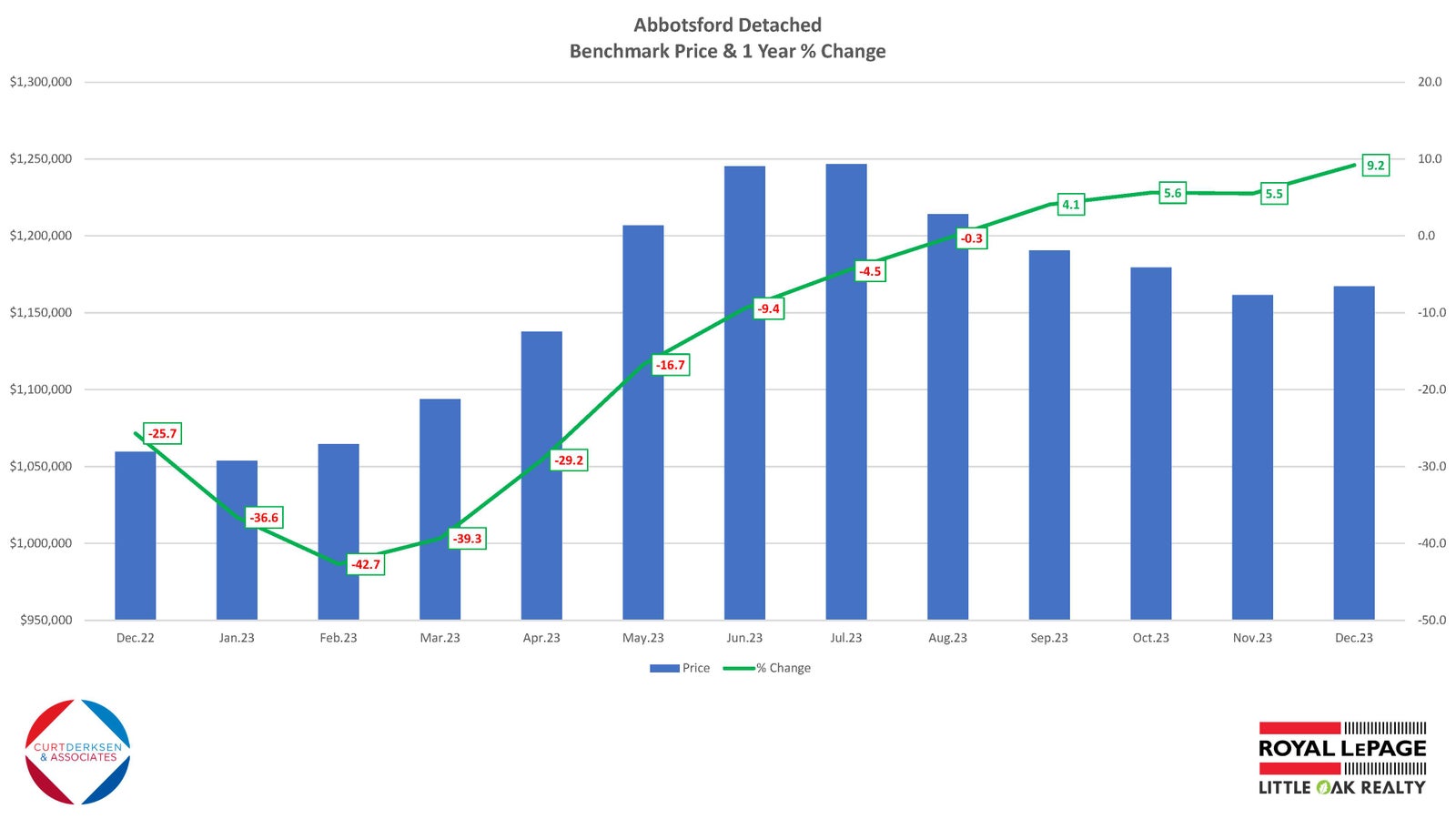

The composite Benchmark home price in the Fraser Valley closed the year at $988,900, down six percent from its 2023 peak in July, but up on the year by five percent.

“Back-to-back mid-year interest rate hikes slowed the market despite strong sales and new listings in the spring,” said Narinder Bains, Chair of the Fraser Valley Real Estate Board. “This left the market in overall balance for the latter half of the year, albeit at low levels of activity. We anticipate 2024 will bring increased optimism on behalf of buyers and sellers as the Bank of Canada is expected to lower interest rates before mid-year.”

December 2023

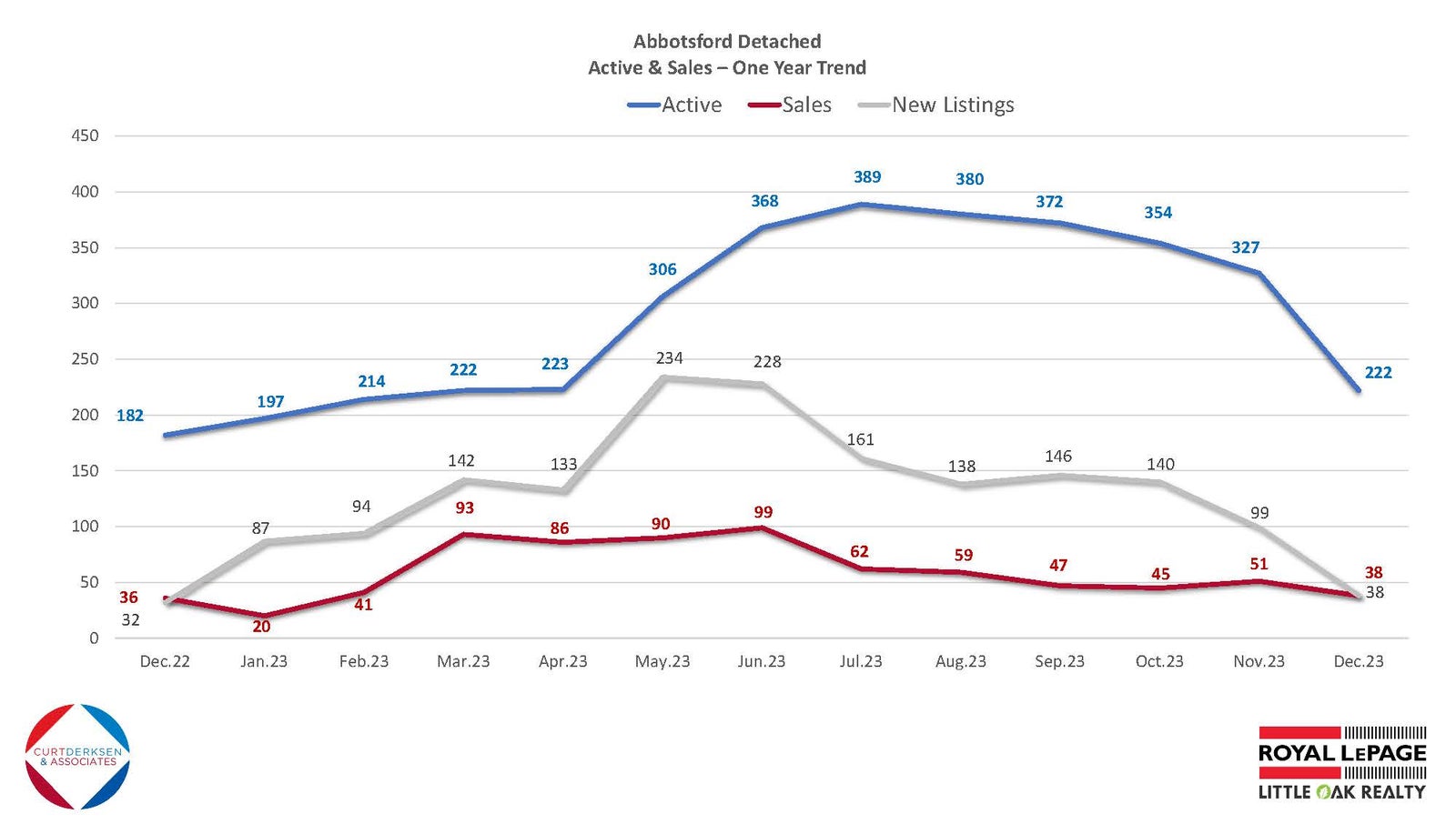

For the month of December, the Board recorded 837 sales on its MLS®, a drop of six percent from November, but 17 percent higher than December 2022.

At 942, new listings dropped by 54 percent in December, but increased 17 percent compared to December of 2022. Total active listings for December stood at 4,670, a decrease of 25 percent month-over-month, but 19 percent higher year-over-year.

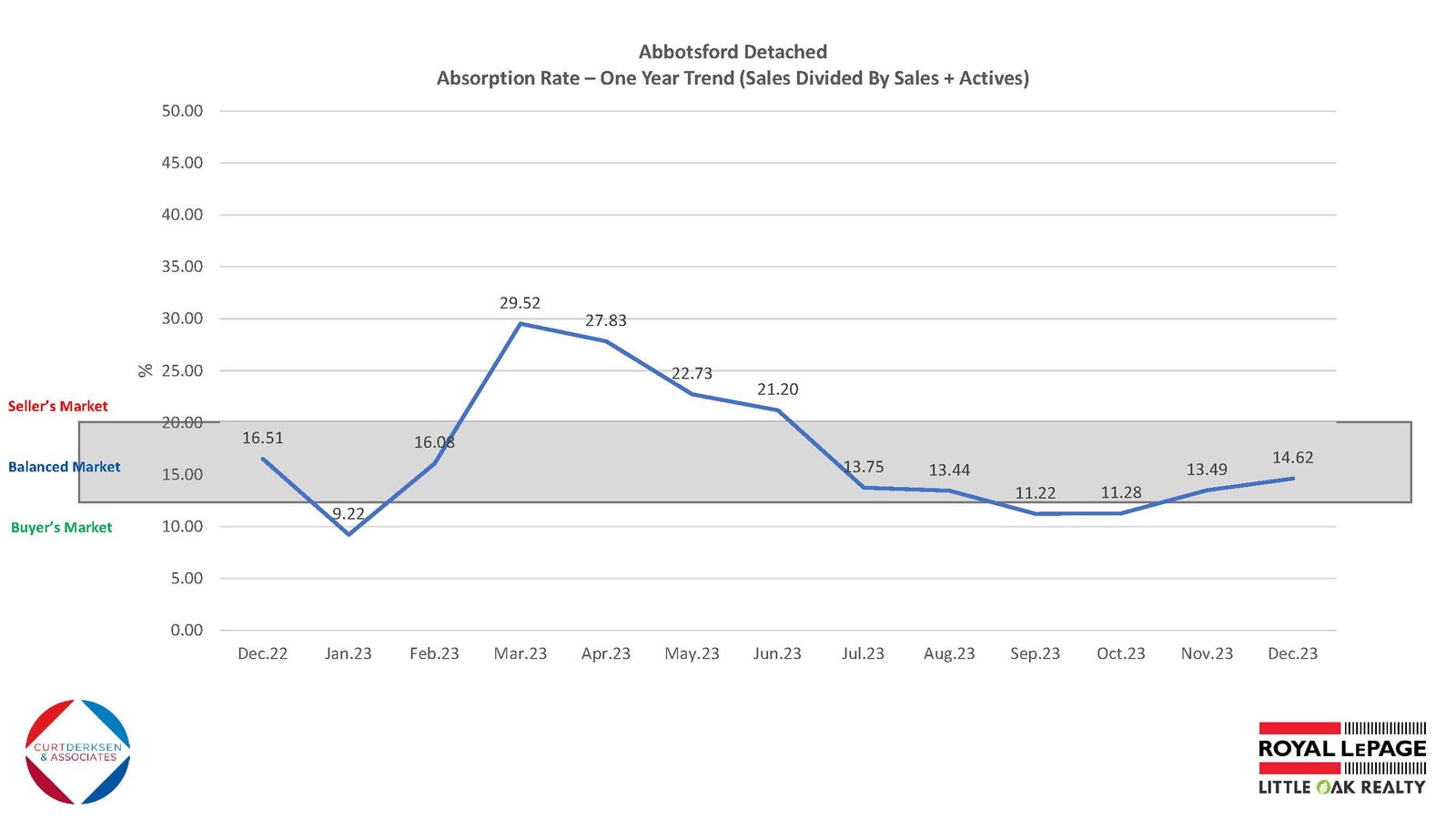

With a sales-to-active listings ratio of 18 per cent for December, the overall market closed out the year in balance. Detached houses closed out 2023 with a ratio of 16 percent, while both townhomes and apartments remained in seller’s market territory at 29 and 26 percent respectively. The market is considered balanced when the ratio is between 12 percent and 20 percent.

“2023 saw buyers and sellers adjust to new rate realities, and the impact of those high rates were reflected in the low number of sales in the Fraser Valley,” said FVREB CEO Baldev Gill. “However, as rates start to ease, we expect market activity will pick up. This will create opportunities for buyers and sellers who are advised to consult with a professional REALTOR® before jumping into the market.”

On average, properties spent approximately 41 days on the market, with single family detached homes spending 40 days on the market. Townhomes and apartments moved more quickly at 32 and 33 days respectively.

Overall Benchmark prices continued to slide for the fifth month in a row, losing 1.5 per cent compared to November.

MLS® HPI Benchmark Price Activity

Single Family Detached: At $1,471,500, the Benchmark price for an FVREB single-family detached home decreased 1.2 percent compared to November 2023 and increased 7.1 percent compared to December 2022.

Townhomes: At $826,400, the Benchmark price for an FVREB townhome decreased 1.3 percent compared to November 2023 and increased 5.3 percent compared to December 2022.

Apartments: At $537,600, the Benchmark price for an FVREB apartment/condo decreased 1.4 percent compared to November 2023 and increased 6.9 percent compared to December 2022.